That low unit price from an overseas supplier looks great in your budget spreadsheet. But weeks later, surprise invoices for brokerage, tariffs, and inland freight decimate your project's profitability. Suddenly, your "low-cost" enclosure is one of the most expensive components in your BOM.

To calculate the Total Landed Cost, you must sum all expenses required to get an enclosure from the factory floor to your warehouse. This includes the unit price, tooling, international freight, insurance, customs duties, tariffs, and local delivery fees. Only then can you find the true cost per piece.

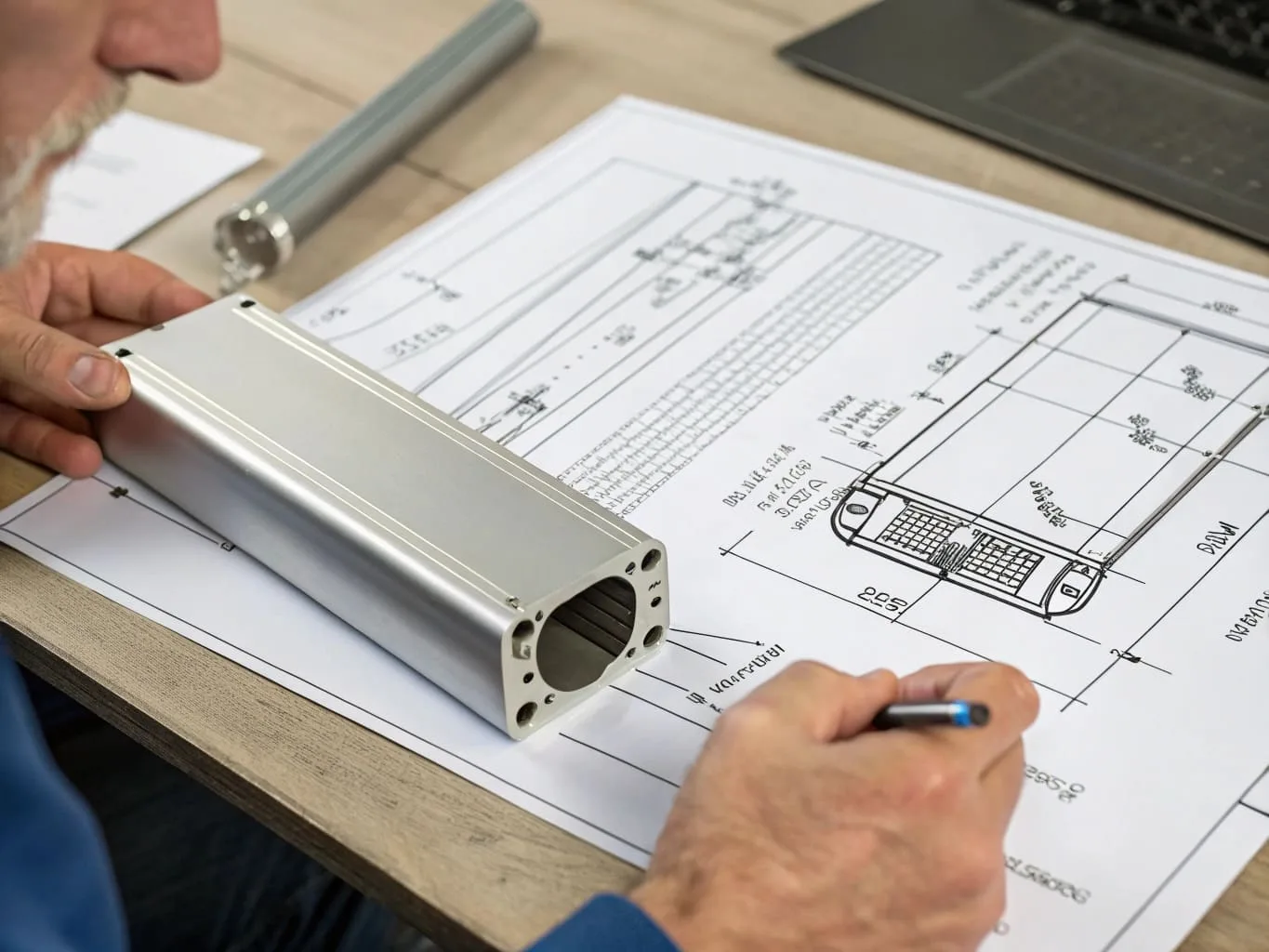

"Calculating the total cost of custom manufactured enclosures"

"Calculating the total cost of custom manufactured enclosures"

Basing a decision on the supplier's initial quote is one of the most common budget-killers I see. Let’s build a simple system to give you a complete and accurate financial picture from day one.

What Costs Am I Forgetting Beyond the Unit Price and Shipping?

You’ve accounted for the per-piece price and the ocean freight quote. Your budget should be solid, right? But what about the litany of fees that only appear after the goods arrive in your country?

Engineers consistently overlook customs duties, tariffs, brokerage fees, and inland transportation costs. These "hidden" fees are rarely included in a supplier's quote and can easily add 15-30% to your total project cost, turning a profitable design into a financial liability.

"Avoiding surprise fees on enclosure shipments"

"Avoiding surprise fees on enclosure shipments"

When we provide an FOB (Free On Board) price, it means we are responsible for the goods until they are loaded onto the vessel at our port. The rest of the journey is on you. This is where the costs begin to accumulate.

The Tariff Trap

Several years ago, a US-based client in the smart grid sector placed a large order. They had carefully budgeted based on our unit price and a freight estimate. What they missed was the Section 301 tariff on goods from China, which at the time added a 25% tax on their specific HS Code (Harmonized System code for enclosures). Their $80,000 order was hit with an additional $20,000 customs bill they hadn't planned for. It completely erased their margin. This wasn't a supplier issue; a customs broker could have forecast this tax in five minutes.

That experience taught me that helping our clients understand these downstream costs is part of our job.

The "Hidden Cost" Checklist

These are the line items you must investigate before placing an order.

| Cost Category | What It Is & Why It Matters | How to Estimate It |

|---|---|---|

| Customs Duties/Tariffs | Taxes your government levies on imported goods based on their type (HS Code) and origin. This is often the largest hidden cost. | Provide your customs broker with the HS Code 8538.10 for aluminum enclosures and ask for the duty/tariff rate. |

| GST / VAT | A Value-Added Tax common in Europe, Canada, and elsewhere. It's calculated on the total value of the goods plus duties. | Check your country's standard GST/VAT rate for imported commercial goods. |

| Customs Brokerage Fee | The fee charged by a licensed broker to handle customs clearance paperwork on your behalf. It can be a flat fee or a percentage. | Ask your freight forwarder or a standalone broker for their fee structure. Often $150-$500 per entry. |

| Inland Freight | The cost to transport your enclosures from the destination port (e.g., Long Beach, Rotterdam) to your actual facility. | Get a quote from a local trucking company or ask your freight forwarder to quote a "door-to-door" service. |

| Port / Handling Fees | Various fees charged at the destination port for unloading, storage (demurrage), and other terminal services. | These are often bundled into a door-to-door freight quote but should be verified. |

Don't assume your freight quote includes these. Explicitly ask for a "door-to-door" quote that includes all charges to avoid surprises.

How Can I Build a Simple Spreadsheet to Predict These Costs?

Theoretical costs are confusing. To gain real control, you need a simple, reusable tool. You don't need complex software—just a basic spreadsheet that maps out every potential expense.

Create a spreadsheet with four sections: 1) Product Costs, 2) Logistics Costs, 3) Import & Compliance Costs, and 4) Final Calculation. By plugging in quotes and estimates for each line item, you can generate a reliable landed cost per unit.

"Spreadsheet for calculating enclosure costs"

"Spreadsheet for calculating enclosure costs"

I use this exact method with clients to provide total cost transparency. It replaces ambiguity with clear, data-driven figures.

The Four-Part Landed Cost Model

Let's build it with a sample order: 500 custom enclosures.

1. Product Costs (from Supplier)

This is the direct quote from your manufacturing partner.

| Line Item | Calculation | Cost |

|---|---|---|

| Unit Price | $30.00 | - |

| Quantity | 500 | - |

| Total Product Cost | $30.00 x 500 | $15,000 |

| One-Time Tooling (Die) | $1,500 |

2. Logistics Costs (from Freight Forwarder)

Get a door-to-door quote if you can. If not, build it up.

| Line Item | Notes | Cost |

|---|---|---|

| Ocean Freight & Handling | EXW China to US Port | $950 |

| Cargo Insurance | 0.6% of goods value | $90 |

| Inland Freight | Port to your door | $600 |

| Total Logistics Cost | $1,640 |

3. Import & Compliance Costs (from Customs Broker)

The critical part most people miss. The "CIF Value" (Cost, Insurance, Freight) is what duties are based on. CIF = Product Cost + Logistics Cost = $15,000 + $1,640 = $16,640

| Line Item | Calculation | Cost |

|---|---|---|

| US Tariff (Sec 301, 25%) | 0.25 x $15,000 | $3,750 |

| US Duty (3%) | 0.03 x $15,000 | $450 |

| Brokerage Fee | Flat fee | $250 |

| Total Import Cost | $4,450 |

4. Final Calculation

| Line Item | Calculation | Value |

|---|---|---|

| TOTAL PROJECT OUTLAY | $15,000 + $1,500 + $1,640 + $4,450 | $22,590 |

| Landed Cost (Excluding Tooling) | ($22,590 - $1,500) / 500 | $42.18 / unit |

| True Cost (First Run) | $22,590 / 500 | $45.18 / unit |

That $30.00 unit price is now $42.18. That's a 40% increase from the number on the quote. Now you have a real number to use for budgeting and pricing your final product.

How Do I Use Landed Cost to Compare Two Different Suppliers?

You have a quote from an overseas supplier like us and another from a domestic manufacturer. The domestic price is higher, but their shipping is cheaper. How do you make an objective, apples-to-apples comparison?

Don't compare unit prices; compare the final landed cost per unit. A supplier with a 10% higher unit price might be the cheaper option once lower freight, zero tariffs, and reduced inventory risk are factored into the equation.

"Comparing suppliers for rackmount enclosures")

"Comparing suppliers for rackmount enclosures")

This is where your new spreadsheet becomes a powerful decision-making tool. Let's model a comparison for your 500-unit order.

Scenario: Overseas vs. Domestic

Run the numbers for both suppliers through your landed cost model.

| Cost Item | Supplier A (Pumaycase, China) | Supplier B (Domestic, USA) |

|---|---|---|

| Product & Tooling | ||

| Unit Price | $30.00 | $38.00 (26% higher) |

| Order Cost (500 units) | $15,000 | $19,000 |

| Tooling Cost | $1,500 | $2,500 (Higher local labor/material costs) |

| Logistics | ||

| Freight & Insurance | $1,640 | $400 (Ground shipping) |

| Import & Compliance | ||

| Tariffs & Duties | $4,200 | $0 |

| Brokerage Fee | $250 | $0 |

| Total Outlay (First Run) | $22,590 | $21,900 |

| Landed Cost Per Unit | $42.18 (Excluding Tooling) | $38.80 (Excluding Tooling) |

In this realistic scenario, the domestic supplier, despite having a 26% higher unit price, is actually 8% cheaper on a landed cost basis for the first run. The hidden costs of tariffs and international logistics completely inverted the decision. This analysis also doesn't account for the value of shorter lead times and simpler communication, which carry their own financial benefits.

This isn't an argument against global sourcing; we serve clients in 30+ countries. It's an argument for making decisions on complete data. Run the numbers every time.

Conclusion

Stop comparing quotes; start comparing true, total landed costs. This simple spreadsheet method moves you from financial guesswork to engineering precision, ensuring your project stays on budget and on track.